Best electronics store billing software

Automate your billing and inventory management

Trusted by 1 Crore+ businesses for Billing, Inventory and Accounting

myBillBook is perfect for electronics and home appliances stores looking to increase profit margins

“Invoicing was tedious for our electronics business. myBillBook automates data entry, ensuring precise invoices with serial numbers and custom fields.”

Rajesh

Sai home appliances, Bangalore

Recommends myBillBook for:

Product Demo for Electronics Billing Software

“Superb customer service. Helped me set up my account as required”

myBillBook’s top features for Electronics stores

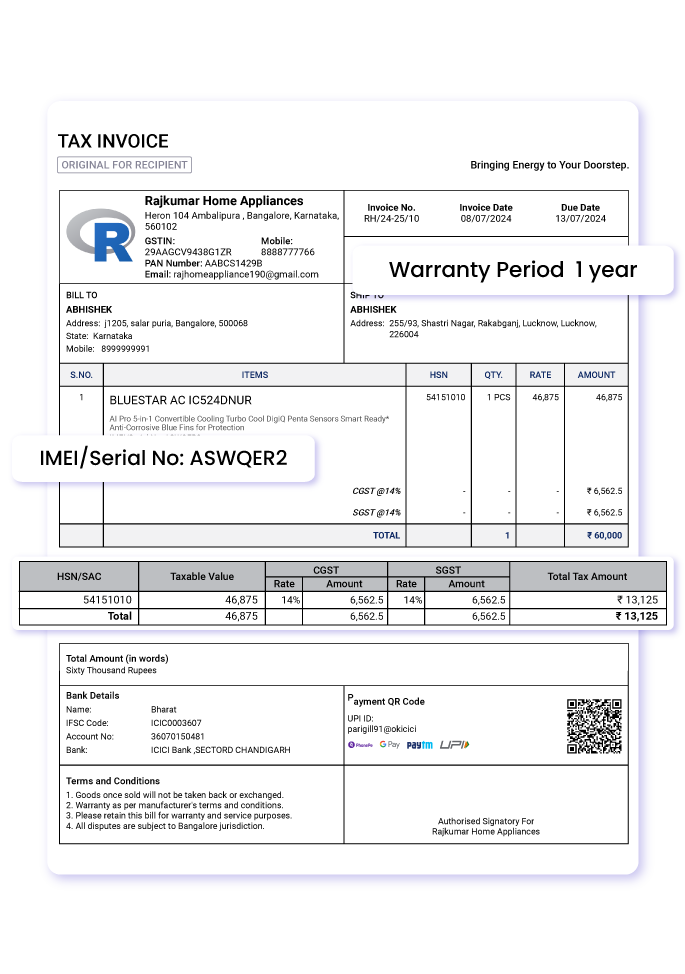

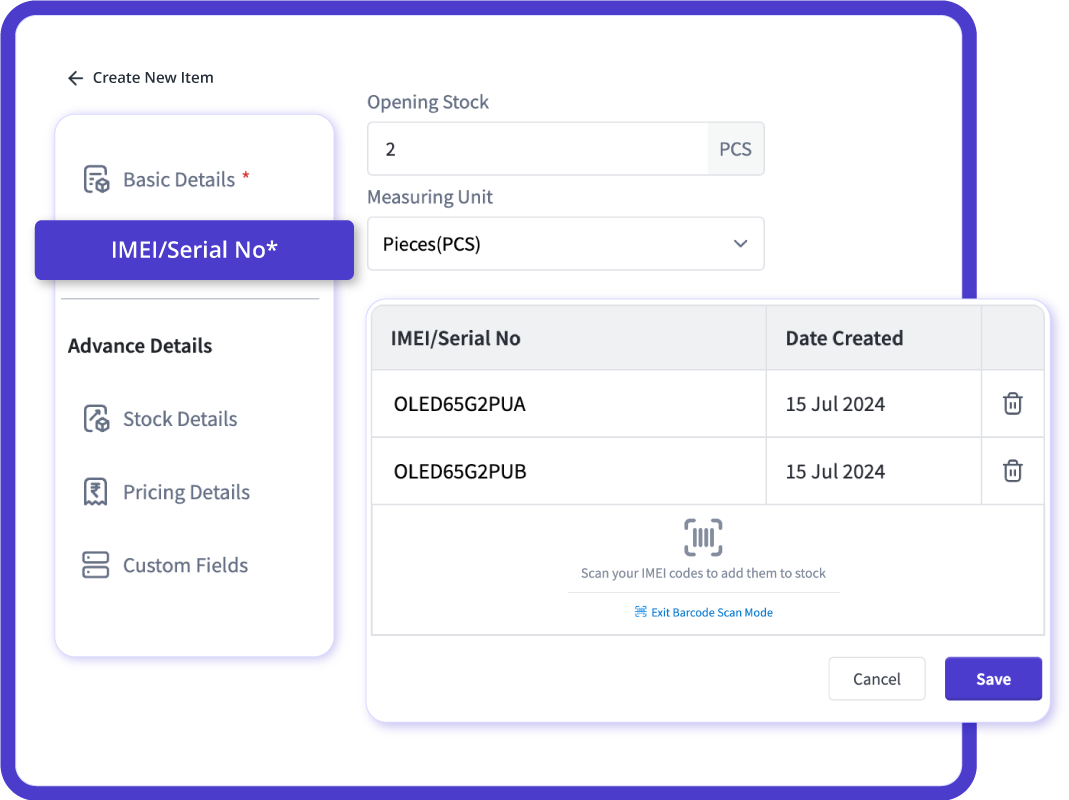

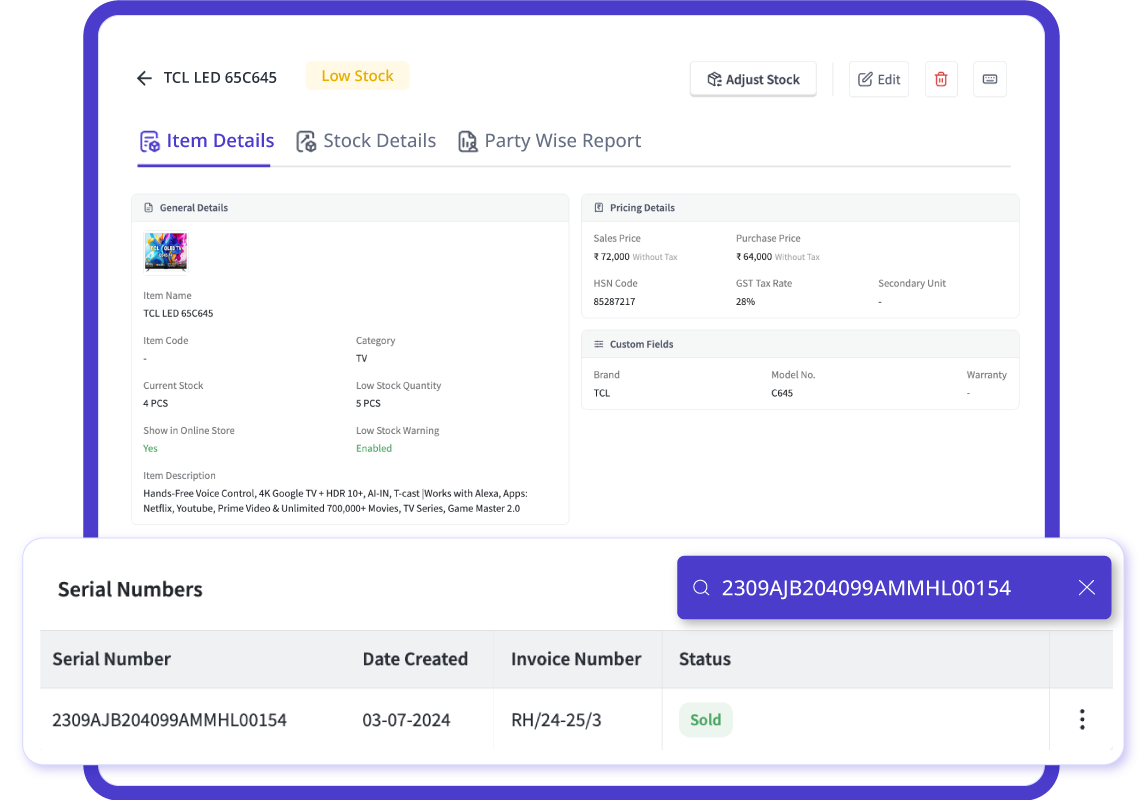

Accurate serialized billing with automated data entry

Create precise invoices effortlessly with myBillBook! Automatically include serial numbers, product details, custom fields, HSN codes, and track salesman performance, ensuring all essential details are accurately recorded.

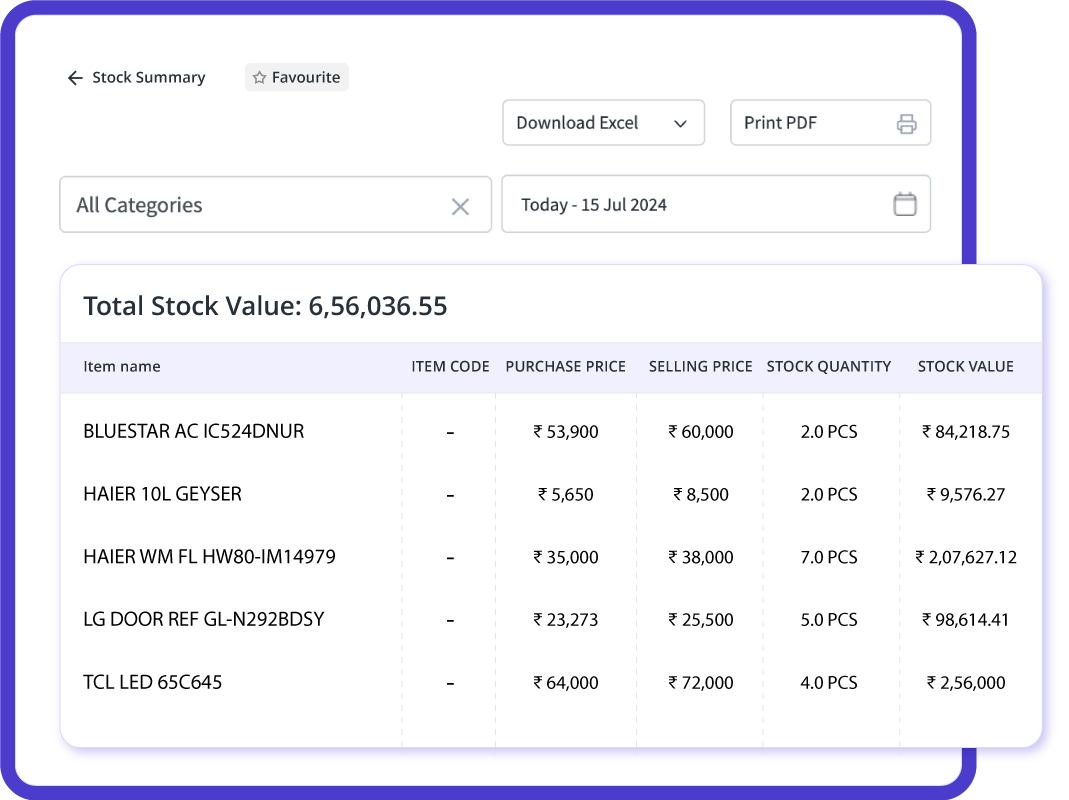

Real-Time Inventory Tracking

Stay ahead with real-time inventory tracking! myBillBook ensures automatic stock adjustments and purchase entries for shop and godown inventory. Get end-of-week summary reports and low stock alerts to keep your inventory perfectly managed and avoid sales loss.

Warranty Management

Manage warranties effortlessly with myBillBook! Easily handle customer enquiries and warranty claims by searching past records by invoice number or mobile number. Provide credit notes for valid claims, ensuring seamless and efficient customer service.

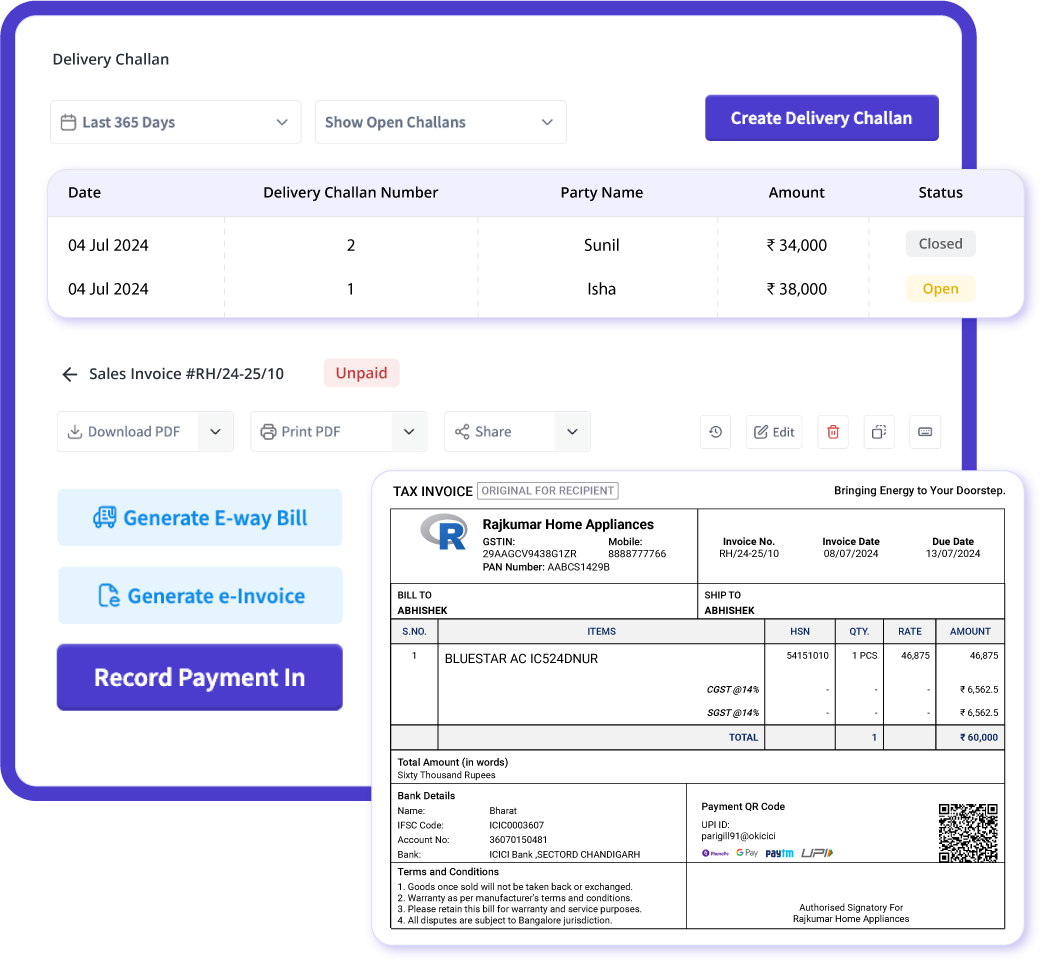

Optimized Delivery Scheduling

With myBillBook, you can ensure timely and efficient deliveries. Easily create delivery challans and e-way bills without the hassle of logging into the government portal every time. Simplify your delivery process and enhance your customer satisfaction with just a few clicks.

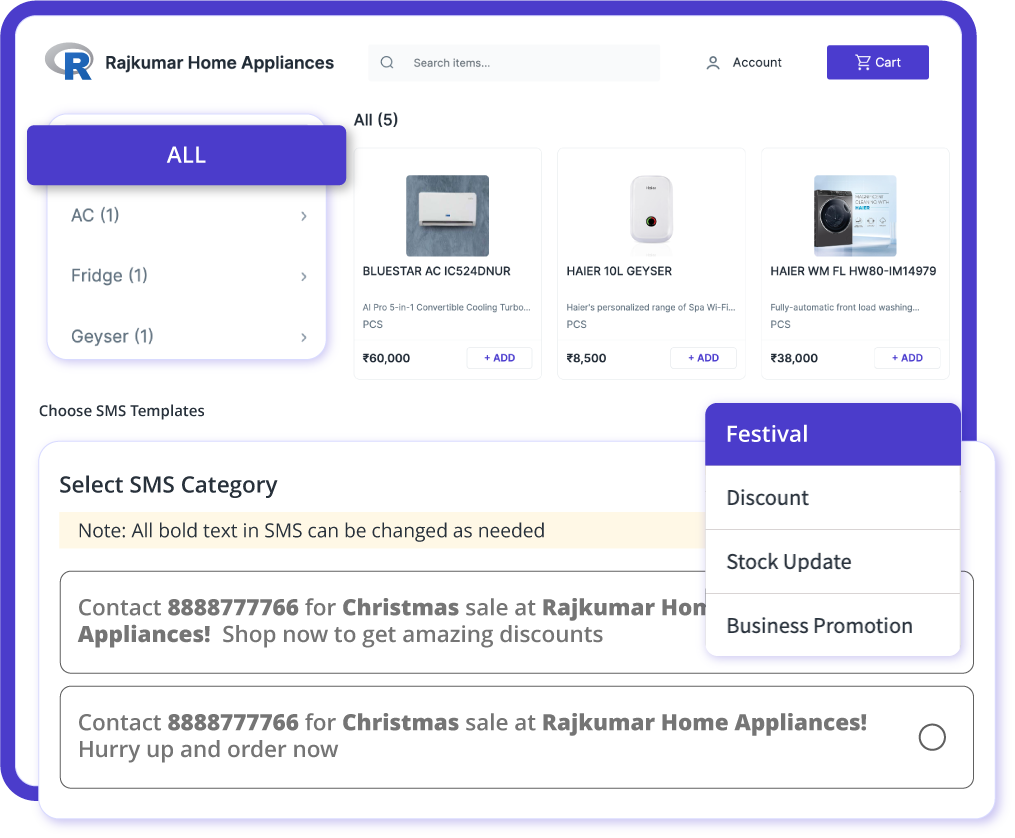

Promotions Management

Boost your sales and expand your reach with myBillBook! Create custom promotions for your inventory items and engage your customers through targeted WhatsApp and SMS marketing campaigns. Take your business online by setting up your own store, allowing you to reach a wider audience and increase your sales potential.

myBillBook helps electronics stores succeed

“Handling warranties was cumbersome and slow. myBillBook simplifies this with easy searches by invoice or mobile number, and seamless credit note issuance. This has dramatically improved our customer service and made warranty management effortless.”

Raj Shekar,

Reddy electronics, Vijaywada

“Managing promotions was challenging. With myBillBook, we easily create custom promotions and reach customers via targeted WhatsApp and SMS campaigns. Our online store has expanded our reach, significantly boosting sales and solving our marketing pains.”

Priyam Yadav,

Best electronics, Patna

“Invoicing used to be tedious and error-prone. myBillBook automates data entry, ensuring precise invoices with serial numbers, product details, custom fields, and HSN codes. Tracking salesman performance is seamless, turning a major pain into a dream gain!”

Ravi Sharma,

Modern electronics store, Chennai

Pricing plans

Diamond Plan

₹217

Per month. Billed annually. Excl. GST @18%

✅ Create unlimited invoices

✅ Add up to 1 business + 1 user

✅ Inventory management

✅ App + Web support

✅ Priority customer support

✅ GSTR reports in JSON format Popular

Platinum Plan

₹250

Per month. Billed annually. Excl. GST @18%

Everything on Diamond Plan +

✅ Add up to 2 business + 2 user

✅ 50 e-Way bills/year

✅ Staff attendance + payroll

✅ Godown management

✅ Whatsapp and SMS marketing Popular

Enterprise Plan

₹417

Per month. Billed annually. Excl. GST @18%

Everything on Platinum Plan +

✅ Custom invoice themes

✅ Create your online store

✅ Generate and print barcode

✅ POS billing on desktop app

✅ Unlimited e-Invoices & e-Way bills

What is Electronics Billing Software?

Electronics billing software is a specialised billing software designed to help electronic appliance stores automate the billing and inventory management processes. The billing software for electronics stores caters specifically to the needs of businesses dealing in electronic goods and offers features that simplify the management of sales, inventory, purchases, and customer relationships.

Features of myBillBook Billing Software for Electronics Appliance Stores

Tax-Complaint Bills

Using myBillBook billing software for electronics businesses, you can generate GST and non-GST invoices. For GST invoices, the software will automatically populate the mandatory details, such as GSTIN, HSN/SAC codes, and tax amounts, thus ensuring compliance. On the other hand, you can also generate non-GST invoices for exempt transactions. This flexibility ensures businesses can efficiently manage all types of transactions, maintaining accuracy and compliance.

Stock Management

Managing inventory is crucial for electronics shops, and myBillBook provides exceptional inventory management features like real-time tracking of stock levels, multi-location stock management, and batch-wise and expiry date tracking. These features help you in reducing wastage, manage stock efficiently, and make informed purchasing decisions.

Purchase Order Management

The Purchase order management feature streamlines the procurement of your electronics business by allowing you to create, manage, and track purchase orders with detailed information. The purchase order contains product descriptions, quantities, and supplier details. You can also have access to purchase history to analyse purchasing patterns for informed decision-making.

Sales Management

With this feature, the billing software for electronics optimises the sales process by handling all aspects of customer transactions. It allows the creation of detailed, professional invoices that reflect the brand image and track sales orders from initiation to fulfilment, ensuring timely delivery and accurate record-keeping. It also provides sales analytics and reporting tools that help businesses monitor performance, identify trends, and make data-driven decisions to enhance sales strategies and customer satisfaction.

Expense Tracking

With the expense tracking feature, you can monitor and manage your business expenditures efficiently. You can record and categorise all types of expenses, including operational costs, supplier payments, and other financial outflows. This reduces manual errors and provides real-time insights into spending patterns, helping you to identify cost-saving opportunities and maintain better control over your finances.

Customer Management

myBillBook billing software for electronics enables you to maintain detailed profiles for each customer, including contact information, purchase history, and payment status. With this information, you can track customer preferences, provide personalised service and target marketing efforts. The customer management feature also includes automated reminders for follow-ups, payment dues, and renewals. Overall, this feature improves customer satisfaction and fosters long-term relationships, driving customer loyalty and business growth.

Benefits of Using myBillBook Billing Software for Your Electronics Appliances Store

Increased Efficiency

The automation of invoicing, inventory management, and purchase tracking reduces manual work, streamlines workflows, and minimises errors. This efficiency frees up valuable time for store staff to focus on customer service and strategic tasks, ultimately leading to smoother operations and quicker transaction processing.

Better Financial Control

With accurate expense tracking and financial reporting, myBillBook enables electronics stores to maintain better financial control. Businesses can closely monitor their expenditures, manage budgets more effectively, and identify cost-saving opportunities. This enhanced financial oversight helps in avoiding overspending, ensuring timely payments, and maintaining a healthy cash flow, which contributes to overall financial stability and profitability.

Improved Inventory Management

Effective inventory management through myBillBook allows electronics stores to keep optimal stock levels and reduce waste. By having a real-time view of inventory and receiving alerts for low stock, businesses can prevent stockouts and overstocking, leading to better inventory turnover and reduced holding costs. This optimization ensures that popular products are always available, enhancing customer satisfaction and sales.

Enhanced Customer Satisfaction

myBillBook helps electronics stores enhance customer satisfaction by enabling accurate and timely invoicing, personalized service, and efficient handling of customer queries and transactions. By maintaining detailed customer profiles and offering tailored promotions, stores can improve the customer experience, leading to increased loyalty and repeat business. Satisfied customers are more likely to return and recommend the store to others.

Strengthened Supplier Relationships

The software’s purchase management features allow electronics stores to build stronger relationships with suppliers. By keeping detailed records of purchases and supplier interactions, businesses can negotiate better terms, manage deliveries more effectively, and ensure timely procurement. Strong supplier relationships contribute to a more reliable supply chain and better overall procurement efficiency.

Data-Driven Decision Making

myBillBook’s comprehensive reporting and analytics provide electronics stores with valuable insights into their business performance. Access to detailed sales, inventory, and financial reports allows store owners to make informed decisions based on real data. This data-driven approach helps in identifying trends, optimising operations, and developing strategies that drive growth and improve competitive advantage.

FAQs on Billing Software for Electrical & Electronics Shops

Is myBillBook suitable for small and medium-sized electronics stores?

Yes, myBillBook is designed to cater to the needs of small and medium-sized electronics stores. Its user-friendly interface, customizable features, and scalability make it an ideal solution for businesses looking to streamline their billing, inventory, and financial management processes.

Can myBillBook manage inventory for a wide range of electronic products?

Yes, myBillBook is well-suited for managing the inventory of diverse electronic products. It provides real-time tracking of stock levels, handles batch-wise and expiry date tracking for electronics with specific shelf lives, and allows for detailed categorisation of different product types.

How does myBillBook assist with the management of electronic product warranties?

While myBillBook doesn’t specifically manage warranties, it helps electronics stores keep detailed customer records and purchase histories, which can be used to track warranty periods and handle claims.You can easily access purchase details, verify warranties and address customer service issues related to electronic products.

What is the difference between billing software for electronics shops and billing software for electrical shops?

While the essential functions of invoicing, payment processing, customer management, and inventory tracking are the same for both types of software, billing software for electronics shops may have additional features specific to the unique needs of electronics businesses, such as handling warranties and returns.

How can billing software for electronics shops help improve business efficiency?

Automating manual tasks, streamlining processes, and billing software for electronics shops can help businesses save time, reduce errors, and improve customer satisfaction.

What are the standard features needed in billing software for electronics shops?

Both types of software typically offer invoicing and payment processing, customer management, inventory management, reporting and analytics, automated reminders, and robust security measures.

Can billing software for electronics shops integrate with other software and systems?

Many billing software solutions offer integrations with other software and systems, such as accounting software, inventory management systems, and e-commerce platforms. These integrations can help businesses streamline their processes and work more efficiently.

What are the advantages of using billing software for electronics shops regarding customer satisfaction?

Automating and streamlining invoicing, payment processing, and customer management, billing software for electronics shops, can help improve customer satisfaction by reducing errors and improving response times.

Know more about Billing & Accounting Software for Small Businesses

Retail Inventory Management Software

Real Estate Billing and Accounting Software

Department Store Billing Software

Ecommerce Inventory Management Software

Travel Agency Accounting Software

Restaurant Inventory Management Software

Construction Accounting Software