Balance Sheet

What Do You Mean by a Balance Sheet?

The balance sheet shows a company’s total assets and how they finance assets through debt or equity. The sheet is also called a net worth statement or a statement of financial position.

It is one of the primary financial statements required for financial modelling and accounting.

The balance sheet depends on an equation: Assets = Liabilities + Equity.

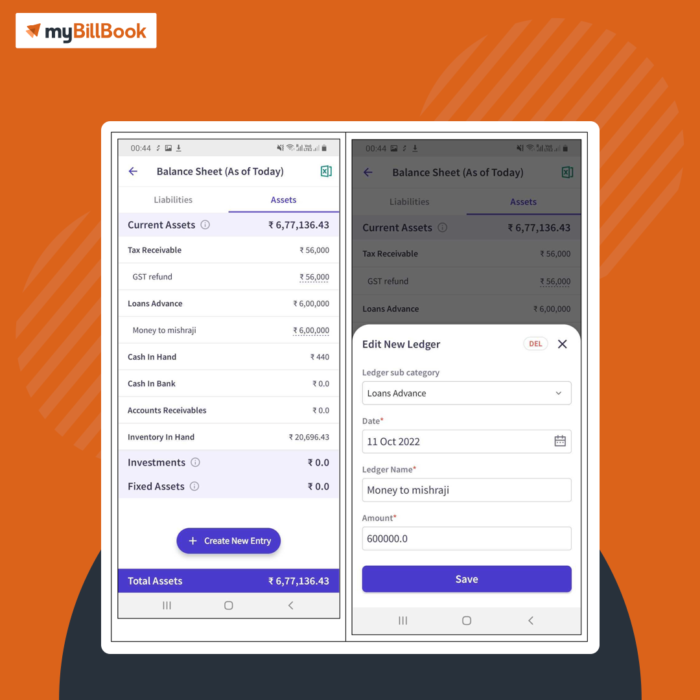

Balance Sheet Example

You can see a completed balance sheet below. It can assist you in better understanding the information contained on these sheets.

Non-Current Liabilities

Bonds Payable

Bonds payable include the amortised amount of any bonds issued by a company.

Long-Term Debt

Long-term debt includes the total amount of long-term debt. It excludes the current portion if the account is under current liabilities).

The account is from the debt schedule, and it outlines the following:

- A company’s outstanding debt

- The interest expense

- Principal repayment for all periods

Components of a Balance Sheet

Assets

Current Assets

Cash and Equivalents

Cash is an asset that appears on the first line of the balance sheet. Cash Equivalents include assets with short-term maturities under three months or assets that a company can liquidate on short notice. Such short-notice assets are called marketable securities.

Note: Companies disclose what their cash assets include in the balance sheet’s footnotes.

Accounts Receivable

Accounts receivable includes the balance of all the sales revenue still on credit. Therefore, it is a total of allowances for doubtful accounts.

This account decreases but cash increases by the same amount as companies recover accounts receivables.

Inventory

Inventory includes raw material amounts, work-in-progress goods, and finished goods.

A company can use this account to report goods sales under the cost of the goods sold in the income statement.

Non-Current Assets

Plant, Property, and Equipment (PP&E)

A company’s tangible fixed assets include Property, Plant, and Equipment (also known as PP&E). The line item has noted a total of the accumulated depreciation.

Companies categorise their PP&E by the different types of assets, like Land, Building, and equipment types. All of the PP&E is depreciable except for Land.

Intangible Assets

Intangible assets are a company’s fixed assets, which may or may not be identifiable. For example, they can be patents, licenses, and secret formulas. On the other hand, unidentifiable intangible assets include brands and goodwill.

Current Liabilities

Accounts Payable

Accounts Payable, or AP, means an amount owed to suppliers for goods or services they purchase on credit. The cash account decreases proportionally as the company pays off its accounts payable.

Current Debt/Notes Payable

Current debts include non-AP obligations due within one year or the company’s one operating cycle (whichever is the longest).

Notes payable can also have a long-term version, including notes with a maturity of more than one year.

Current Portion of Long-Term Debt

Although current debt and a current portion may seem similar, they are not. The current portion of long-term debt is due within the current year of a piece of debt, and its maturity is over one year.

Equity

Shareholders’ Equity

Share Capital

Share capital is the value of funds every shareholder has invested in the company.

Usually, shareholders put in cash when they first form a company.

Retained Earnings

Retained earnings are the total net income a company decides to keep. Every period, a company pays out dividends from the net income. Then, you can add any amount remaining (or deduct it from) to the retained earnings.

Difference Between Trial Balance and Balance Sheet

The following are the distinctions between a trial balance and a balance sheet:

Aggregation

The balance sheet aggregates information from multiple accounts. In contrast, the trial balance provides information at the account level.

Standards

The balance sheet is formatted by specific accounting standards, whereas the trial balance has no mandated format.

Usage

Balance sheets are intended for external use, whereas the trial balance is designed for internal use and by auditors.

Level of Reporting

The balance sheet is the final report, whereas the trial balance is the foundation for other reports.

Importance of Balance Sheets

A balance sheet has many advantages regardless of a company’s size or the industry in which it operates.

Determine Risk

Balance sheets determine risk. This financial statement lists all of a company’s assets and liabilities. For example, a business can quickly decide whether or not it has borrowed too much money, the liquidity of its assets, or the cash requirement to meet current demands.

Secure Capital

Balance sheets secure capital as well. For example, a company must typically provide a balance sheet to a lender to secure a business loan. Likewise, to secure private equity funding, the company must provide a balance sheet to private investors.

In both scenarios, the external party wants to assess a company’s financial health, creditworthiness, and ability to repay short-term debts.

Measure Liquidity

Managers can use financial ratios to measure a company’s liquidity, profitability, solvency, and cadence (turnover). These ratios need numbers from the balance sheet. When analysed over time or compared to competing companies, managers can better understand how to improve a company’s financial health.

Attract Clients

Finally, you can use balance sheets to attract and retain talent. Employees typically prefer to know that their jobs are secure and that the company for which they work is in good health.

For public companies that are required to disclose their balance sheet, this allows employees to assess the company’s cash. Thereby employees can determine whether the company is making sound debt management decisions and whether the company’s financial health is as expected from their employer.

Limitations

The balance sheet is helpful information for investors and analysts but has some drawbacks

The Static Nature

Financial ratios use data to paint a complete picture of a company’s operations, and the data is from:

- Balance sheets

- The more dynamic income statement

- Statement of cash flows

However, as balance sheets are static, they cannot provide complete details on a company’s financial health.

Limited Scope

Due to the narrow scope of timing, a balance sheet is limited. The financial statement only reflects a company’s financial position daily. A single balance sheet may make it difficult to determine whether a company is performing well.

Multiple Accounting Systems

Different accounting systems and methods for dealing with depreciation and inventories will also affect the figures on a balance sheet. As a result, managers can manipulate the numbers to make them appear more favourable.

Pay attention to the footnotes on the balance sheet to determine which systems are used in their accounting and to look for red flags.

Professional Judgement

Balance sheets go through several areas of professional judgement that can impact the report.

Without knowing which receivables a company will likely receive, it must make estimates and reflect its best guess as part of the balance sheet.

Uses

To explain the financial position of a company.

A balance sheet can explain a company’s financial position at a specific time. For example, a balance sheet, as opposed to an income statement, is used to determine a company’s health on one particular day.

To gauge the risks of a company.

Parties outside of a company can use a bank statement to assess the company’s health. For example, banks, lenders, and other financial institutions may calculate financial ratios based on balance sheet balances to determine the following:

- Risk a company carries

- Liquidity of its assets

- Solvency of a company

To craft the internal decisions of a company.

A company can use a balance sheet to make internal decisions. Still, the information provided is usually less helpful than an income statement. For example, a company may examine its balance sheet to assess risk, ensure that it has enough cash, and decide how to raise additional capital (through debt or equity).

FAQs on Balance Sheet

What does a balance sheet serve?

A balance sheet offers you a snapshot of the financial position of your company at any time. A balance sheet and an income and cash flow statement can assist business owners in evaluating their company's financial standing.

What is the balance sheet formula?

Total assets = total liabilities + total equity is the formula.

Is cash an asset or a form of equity?

Cash is a current asset and the first item on a company's balance sheet. Cash is the most liquid asset type.