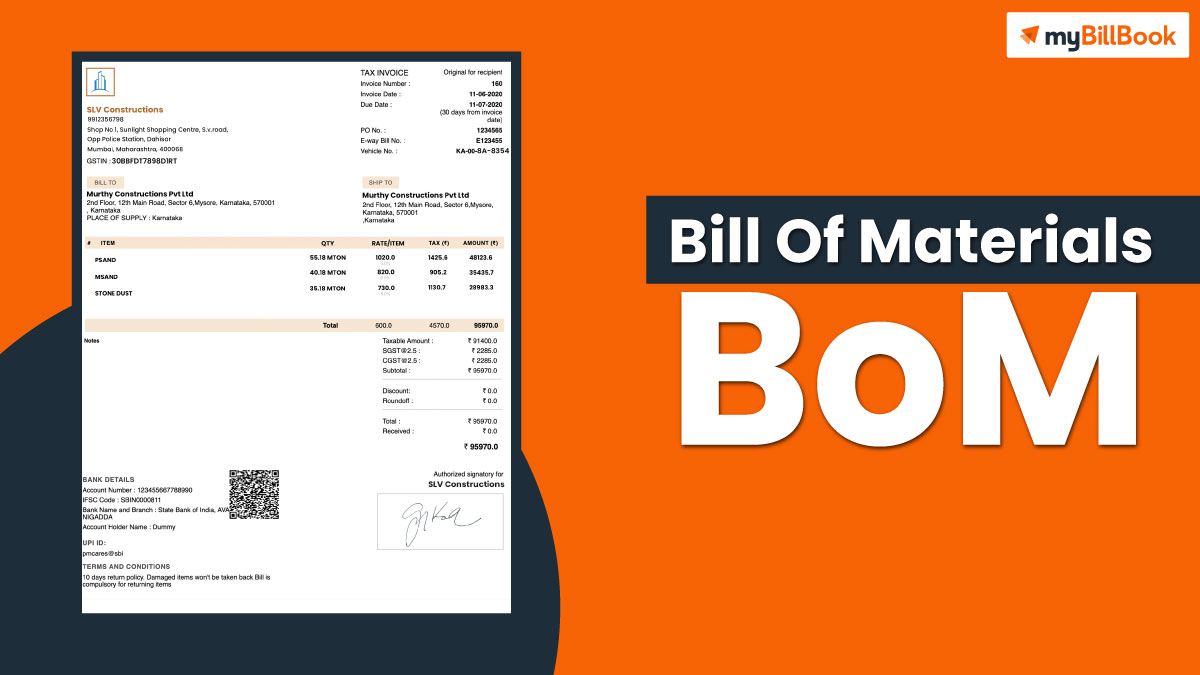

An itemized inventory of all the components necessary to make or sell a product is termed a Bill of Materials (BOM). Succeeding are the BOM meaning and other details.

What is Bill of Materials?

BOM is a comprehensive inventory of all the materials and pieces that a manufacturer requires to make a certain product. The BOM must include not just the raw materials but also any subassemblies, subcomponents, and parts, as well as the exact amounts of each.

The precise layout of a bill of materials will differ based on the essence of the commodity being manufactured, but it is common for each product to have two distinct types of bills of materials:

- one for the engineering phase during which the product is developed, and

- another for the mass production phase during which the product is shipped to customers.

BOM Structure

Structures related to the methods in which the bill of materials records the components of a product. There are typically two methodologies: single-level BOMs, in which all items are consolidated into a single level, and multi-level BOMs, in which things are nested into two or more layers. Individual product and product family structuring decisions can have a major impact on not just a business, but also its supply network and distribution allies.

Single level-BoM: is a comparatively straightforward enumeration of the components that make up a product. Each assembly or subassembly is shown just once in this type, along with the quantity necessary for each to complete the product. While this form of BOM is simple to create, it is insufficient for complicated products since it does not describe the link between parent and child components or assemblies and subassemblies. When a product malfunctions, a single-level BOM complicates determining which component needs to be replaced or repaired.

Multilevel-BoM: is a BOM with several levels that needs more time to produce but gives more information and specificity about the product’s parent and child components. The total amount of material required is shown in a multilayer bill of materials. Additionally, the product’s indented structure demonstrates the relationship between parent and child products, as well as assemblies and subassemblies. Because the bill of materials serves as the foundation for production planning systems and the information contained within it serves as the foundation for additional business activities such as manufacturing resource planning, product costing, material provision for production, and plant maintenance.

Types of Bill of Materials

Most businesses organize their goods and service BOMs to fulfill their specific internal and external goals. Some organizations utilize distinct systems to structure BOMs for Engineering and Manufacturing reasons for a given product and configuration. These Engineering Bills of Materials (EBOMs) and Manufacturing Bills of Materials (MBOMs) can be standalone or integrated into company-wide managed BOMs.

- Manufacturing Bill of Materials (mBOM)

When a company wants to display all of the components and assemblies needed to produce a finished product, they use the manufacturing BOM (mBOM). Parts that need to be processed before assembly must also be included in the mBOM. The document includes information that is distributed to all integrated business systems involved in ordering parts and constructing the product, such as enterprise resource planning (ERP), materials resource planning (MRP), and, in certain circumstances, manufacturing execution systems (MES). For a manufacturing business, this is the most frequent sort of BOM.

The accuracy of the quantity of parts ordered during the manufacturing process is critical to the mBOM. This ensures that the buying department can keep an ideal timetable for ordering essential items and negotiating the best possible price from relevant vendors.

- Engineering Bill of Materials (eBOM)

During the product design process, the engineering BOM (eBOM) is created using Computer-Aided Design (CAD) or Electronic Design Automation (EDA) technologies. The document often lists the items, parts, components, subassemblies, and assemblies in the product as developed by the engineering team, frequently in the order in which they are depicted in the assembly drawings of the parent product. Furthermore, it is not uncommon for more than one eBOM to be connected with a single final product.

- Service BOM

The Service BOM (which is frequently created by engineers during the design process) generally comprises a list of all the parts, installation methods, and repair instructions that service professionals use while installing or servicing a product onsite at the customer’s location.

- Sales BOM

A Sales BOM, unlike other types of BOMs, gives details about a final product prior to its assembly during the sales phase. Both the final product and the components show as independent entries in the sales order document in a Sales BOM. Furthermore, the parent item will be displayed as a sales item rather than an inventory item, and the offspring as sub-items.

- Assembly Bill of Materials

A Sales BOM is similar to an assembly BOM in that the parent item is listed as a sales item rather than an inventory item. However, unlike the Sales BOM, only the final product appears in the sales document; the offspring are not included as sub-items. Assembly BOMs can also be single-level or multi-level.

- Production BOM

In the production stage, the bill of materials (BOM) is frequently used as the basis for a production order. It includes the components and subassemblies that make up a final product, as well as the pricing, descriptions, quantities, and units of measurement connected with them. Physical components can be transformed into final products throughout the manufacturing process. A completely automated BOM system may automatically add component demands, pricing, and material availability to work orders, ensuring that raw materials are correctly assigned to products.

- Template Bill of Materials

A Template BOM is a highly adaptable type of BOM that can be used for both Production and Sales BOMs, with the parent items presented first and the components displayed below. In the BOM or on the sales order, the number of such components can be updated, swapped out, and replaced with other components, or deleted.

- Configurable BOM (cBOM)

A Configurable BOM includes all of the components needed to develop and manufacture material to a customer’s specifications. The cBOM is frequently utilized in areas where goods are highly customizable, such as job shops, heavy machinery, and industrial machines.

- Single-Level BOM

A single-level BOM is generally utilized for goods with simple structures that do not involve subassemblies. This document typically provides a total count of all the components used in the manufacturing of a product, with the pieces listed in part number order. This sort of document’s structure only allows for one level of children in components, assemblies, and material.

- Multi-Level BOM

A multi-level BOM, as opposed to a single-level BOM, is used for more complicated structures and hence contains subassemblies, which are sometimes split down into additional layers of subassemblies. Except at the highest level, each item number (raw material or labour) in this document must be associated with a parent item.

Difference between BOQ and BOM

While the BOM is the inventory list of raw materials, parts, and components, the BOQ is the total quantity of goods required to complete a project.

Advantages of using Bill of Materials

BOMs play an important role in product firms since they specify what goes into a product. Because it specifies the level of importance for modifications, BOM management is critical to Quality Management Systems (QMS) and Product Lifecycle Management (PLM).

A well-defined bill of materials (BOM) assists businesses in the following ways:

– Planning raw material purchases.

– Calculate the cost of materials.

– Take control of your inventories.

– Keep track of and plan for your material requirements.

– Maintain complete and accurate records.

– Ensure supply reliability while also reducing waste.

The elimination of ambiguity guarantees that the product can be reliably replicated and that its quality can be managed. Businesses cannot be certain of the following things until they have it:

– Control of the product’s quality.

– The dependability of the product.

– The constancy of the brand.

– Adherence to regulatory requirements.

– Commitments from customers.